Jan 09, 2026 | Couture AI Team

Retail does not struggle because teams lack plans. It struggles because plans break down once they hit real-world execution.

Every missed trend, late product launch, stockout, and emergency markdown traces back to the same issue: a widening retail execution gap between what retailers decide in planning and what actually happens across stores, warehouses, and marketplaces.

In retail merchandising, this execution gap is now one of the biggest drivers of inventory waste, margin erosion, and slow time-to-market. Industry research consistently shows that a significant share of retail value loss now comes from execution delays rather than planning accuracy, as organizations struggle to respond fast enough once demand shifts.

Planning has improved. Execution has not kept pace.

In today’s retail environment, where demand shifts weekly and sometimes daily, speed of execution matters more than quality of intent. That is where most retailers are falling behind.

For years, retail performance was driven by better planning. Better forecasts. Better assortments. Better buy decisions.

In this environment, even strong plans degrade quickly. By the time decisions move through teams, approvals, and systems, the market has already changed.

This is the retail execution gap.

The execution gap shows up in very practical ways.

On paper, retail looks data-driven. Dashboards exist. Reports refresh. Forecasts are revised.

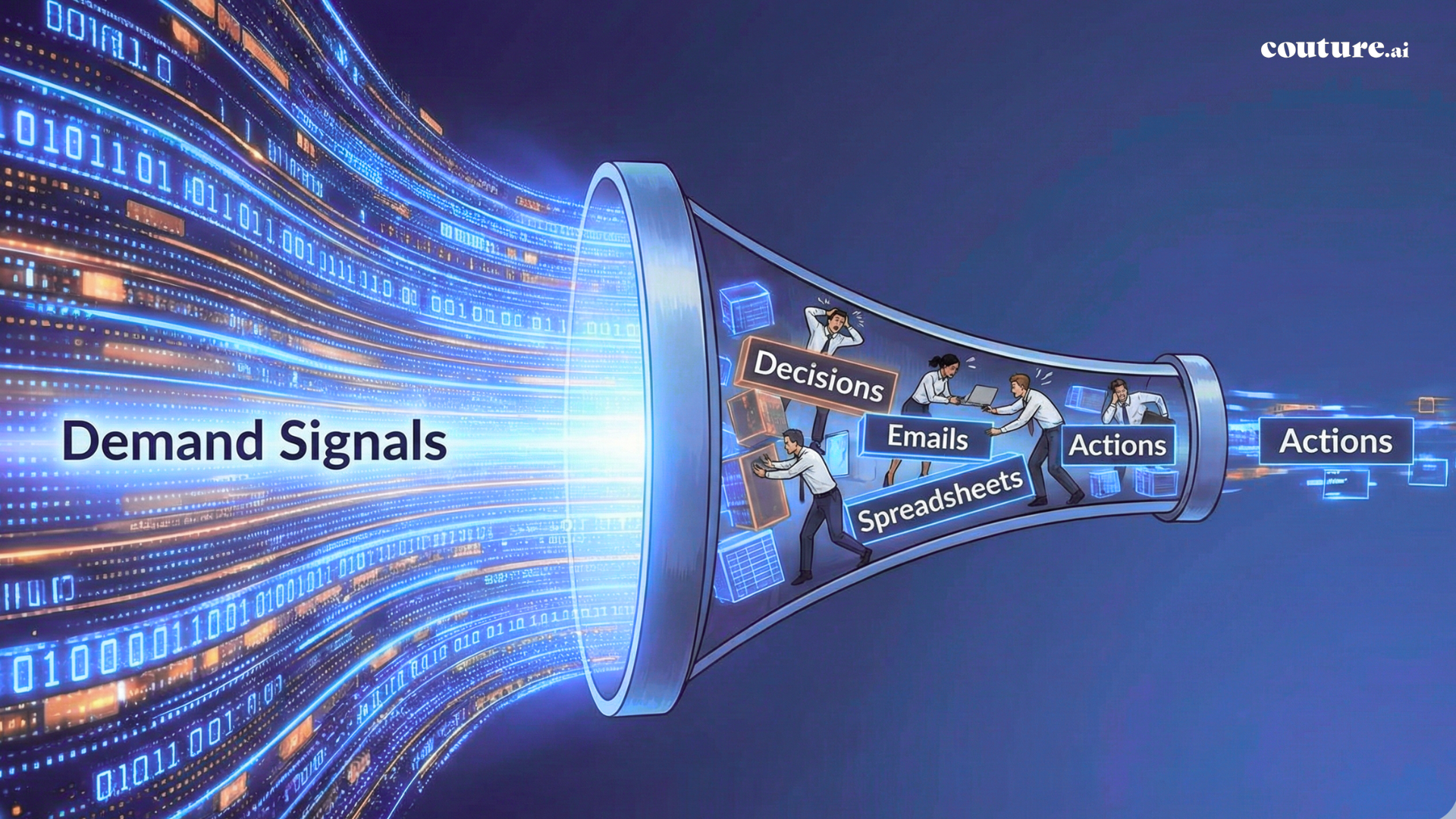

In practice, merchandising still runs on manual coordination. Spreadsheets. Emails. Meetings. Follow-ups. Approvals.

The problem is not insight. The problem is turning insight into action fast enough.

The execution gap is not one issue. It shows up across the merchandising lifecycle.

Retailers now see trends earlier than ever. Social, search, and marketplace data provide constant signals. But response still happens on seasonal or monthly cycles. Speed, not visibility, is the constraint.

Concepts move through design, vendor coordination, sampling, and content creation. Each step adds a delay. By the time products launch, the demand window has narrowed.

Plans assume stable demand. Reality is uneven, regional, and volatile. When assortments cannot adapt in-season, overstocks and stockouts follow.

Inventory often exists somewhere in the network. The issue is positioning it fast enough when demand shifts.

Markdowns are usually reactive. By the time price changes are approved and executed, margin has already been lost. These failures are connected. Fixing one without addressing the others rarely changes outcomes.

Most retailers are not standing still. They are investing in tools, analytics, and AI pilots. Yet the gap continues to widen for four reasons.

The result is predictable: more firefighting, more markdowns, more pressure on teams.

There is a point where asking teams to “move faster” stops working.

When the number of decisions, the speed of demand change, and the scale of execution exceed human coordination capacity, performance degrades. Not because teams are weak, but because the system is outdated.

Retail has crossed that point.

At this stage, automation alone is not enough. Execution needs to become autonomous, with humans supervising outcomes rather than coordinating every step.

At this inflection point, many retailers realize the constraint is no longer planning accuracy, but execution capacity itself.

AI does not fix execution by producing better dashboards. >

It works when it is designed to sense, decide, and act continuously across the merchandising lifecycle.

When these capabilities operate together as a system, execution changes.

Decisions are no longer queued for meetings. They are triggered, validated, and refined continuously. This is what autonomous merchandising looks like in practice.

The impact is operational and financial.

Retailers move from rigid 8–12 week cycles to continuous decision loops that adapt at SKU speed.

The implications are straightforward.

Retail is moving from planning-led to execution-led competition.

Retail outcomes will increasingly depend on how quickly decisions turn into action.

Couture.ai builds autonomous merchandising systems that help retailers close the execution gap across Trend → Store workflows.

The future of retail belongs to organizations that execute faster than the market moves.

Subscribe to get the latest updates and trends in AI, automation, and intelligent solutions — directly in your inbox.

Stay Informed: Insights and Trends from Couture AI

Reduce operational complexity, improve planning accuracy, and deliver smarter retail execution with Couture AI.