Dec 11, 2025 | Couture AI Team

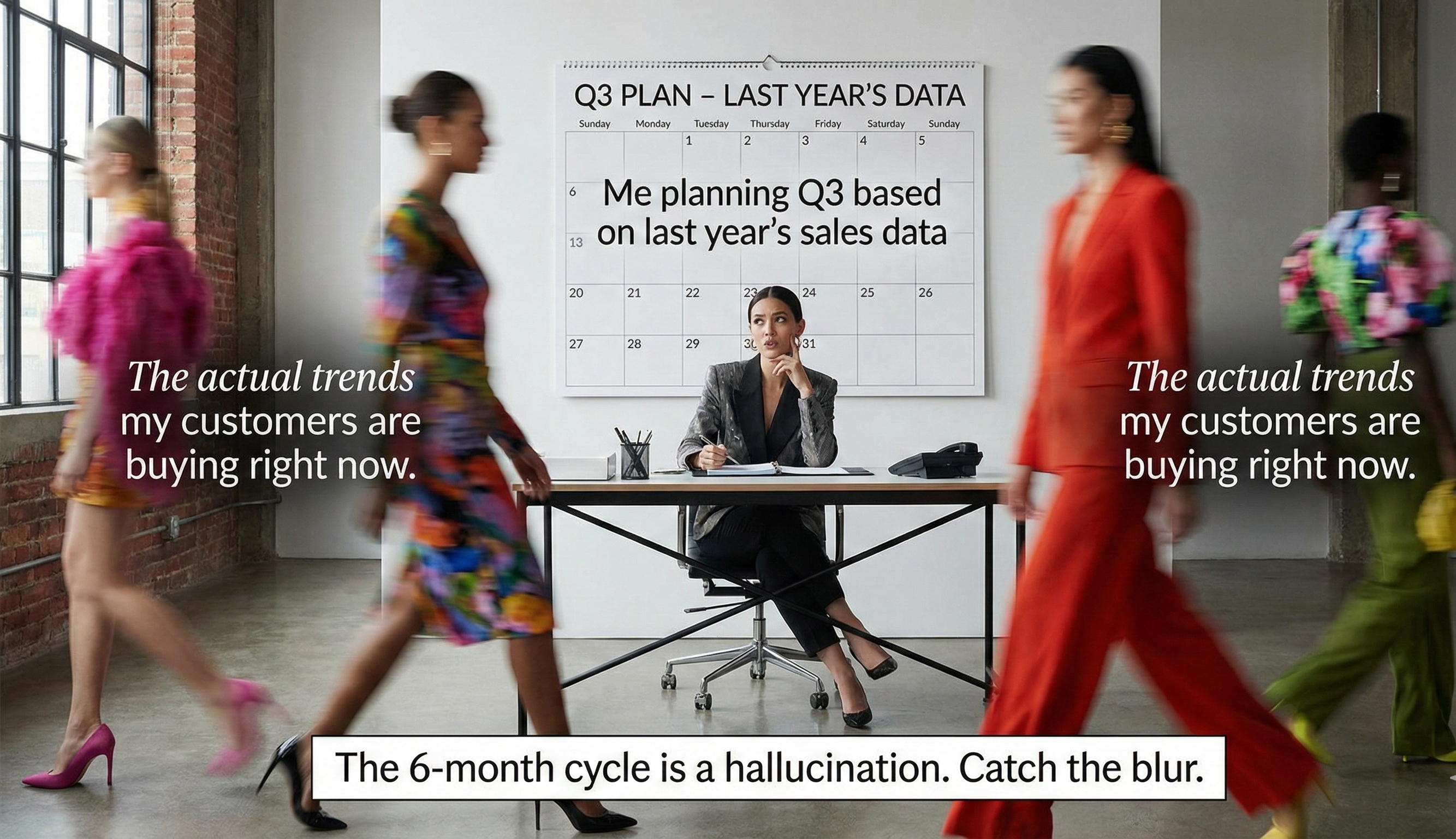

Retail cycles now operate on shorter windows and more fragmented demand patterns. Trends emerge quickly, customers move across channels fluidly, and category complexity continues to rise. Yet most merchandising workflows still follow linear processes built for slower markets. This creates a widening gap between detection and execution, resulting in late trend adoption, reactive planning, and avoidable margin pressure.

A 24-hour Trend → Store cycle is not about forcing speed. It is about aligning decisions with real signals the moment they appear. Retailers moving toward this model are rethinking how information travels across the merchandising system so that each action reflects actual demand.

This blog outlines what it takes to operate at that pace, supported by research from McKinsey, BCG, and leading studies on real-time retail decisioning.

Most retailers still operate across a fixed sequence:

trend reviews → samples → approvals → content → listing → allocation → replenishment. The steps are necessary. The delays between them are not.

Research from McKinsey shows that more than 60 percent of retail cycle time is lost between functions, not within them. BCG highlights similar issues in category planning and forecasting, where decisions depend on stale or incomplete data, leading to late corrections and elevated markdown exposure.

These structural constraints make it difficult to act on trends at the pace customers adopt them.

Operating at 24-hour speed requires three core elements: early signals, a unified intelligence layer, and agentic execution.

To move quickly, retailers need insight before sales data reflects the shift. The strongest early indicators come from:

McKinsey’s research on real-time decision-making shows that retailers using multi-signal models see meaningful improvements in forecast accuracy and in-season agility.

Couture.ai unifies all three layers into a single trend graph that shows what is emerging, accelerating, or flattening.

Signals are only valuable when they reach downstream functions without friction. Most retailers struggle because insights sit in isolated tools.

This ensures teams operate from the same demand logic rather than fragmented systems or siloed data.

Once insights are aligned, execution must follow efficiently.

This is what allows retailers to move from detection → execution in under 24 hours when needed

Instead of long seasonal workflows, the system starts the moment demand appears.

| Phase | How It Works |

|---|---|

| Trend Detection | Rising signals identified across social, search, and commerce |

| Concepting | AI visual prototypes reduce dependency on physical samples |

| Automated Content & Listing | Titles, descriptions, attributes, banners and SEO copy generated instantly |

| Allocation | Depth and placement shift toward regions showing early demand |

| Forecasting | New sell-through data updates forecasting logic and replenishment |

Global retailers using real-time demand signals (McKinsey, 2023) report:

Speed is not theoretical. Its impact is measurable in margin protection and sell-through.

Most retailers do not need a complete transformation. They need the right intelligence foundation and a structured rollout.

Retailers pursuing a faster Trend → Store cycle are not simply accelerating execution. They are redesigning how decisions flow across the merchandising system. Early signals, unified intelligence, and autonomous execution remove friction and help teams respond while demand is still forming.

Couture.ai enables this shift by connecting trend discovery, product creation, listing, allocation, forecasting, and replenishment inside a coordinated decision loop. It helps retailers move from trend identification to live SKU execution with far greater speed and consistency.

To explore how this model works inside real retail environments, schedule a call with our experts!

Subscribe to get the latest updates and trends in AI, automation, and intelligent solutions — directly in your inbox.

Stay Informed: Insights and Trends from Couture AI

Reduce operational complexity, improve planning accuracy, and deliver smarter retail execution with Couture AI.