Your buyers spot a trend in February. It reaches stores in May. By then, demand peaked in March.

That eight-week gap costs you full-price sales, creates markdown pressure, and hands market share to competitors who moved faster. A few retailers tracked this precisely: $40 million in annual losses tied directly to the lag between spotting opportunities and having products available.

Trend lifecycles in retail have compressed significantly, with demand peaks forming and fading within weeks rather than seasons.

Here's what happens when your team identifies a trending product.

Sales data exists in three separate systems. Someone manually pulls reports to confirm the pattern. That takes two days. They build a spreadsheet, email it to planning, buying, and visual merchandising teams. Everyone adds input separately, at different times. Another three days.

Someone consolidates the feedback and tries to schedule a review meeting. Regional managers review against their budgets. Approvals trickle back over five days. Two regions have questions - another round of emails and three more days. Final sign-off comes through. Someone manually creates a purchase order and sends it to the supplier. Two more days.

The decisions took hours. The waiting took weeks.

By the time products arrive, the trend window closed - customers bought from faster retailers. You're stuck discounting 40-60% just to clear inventory.

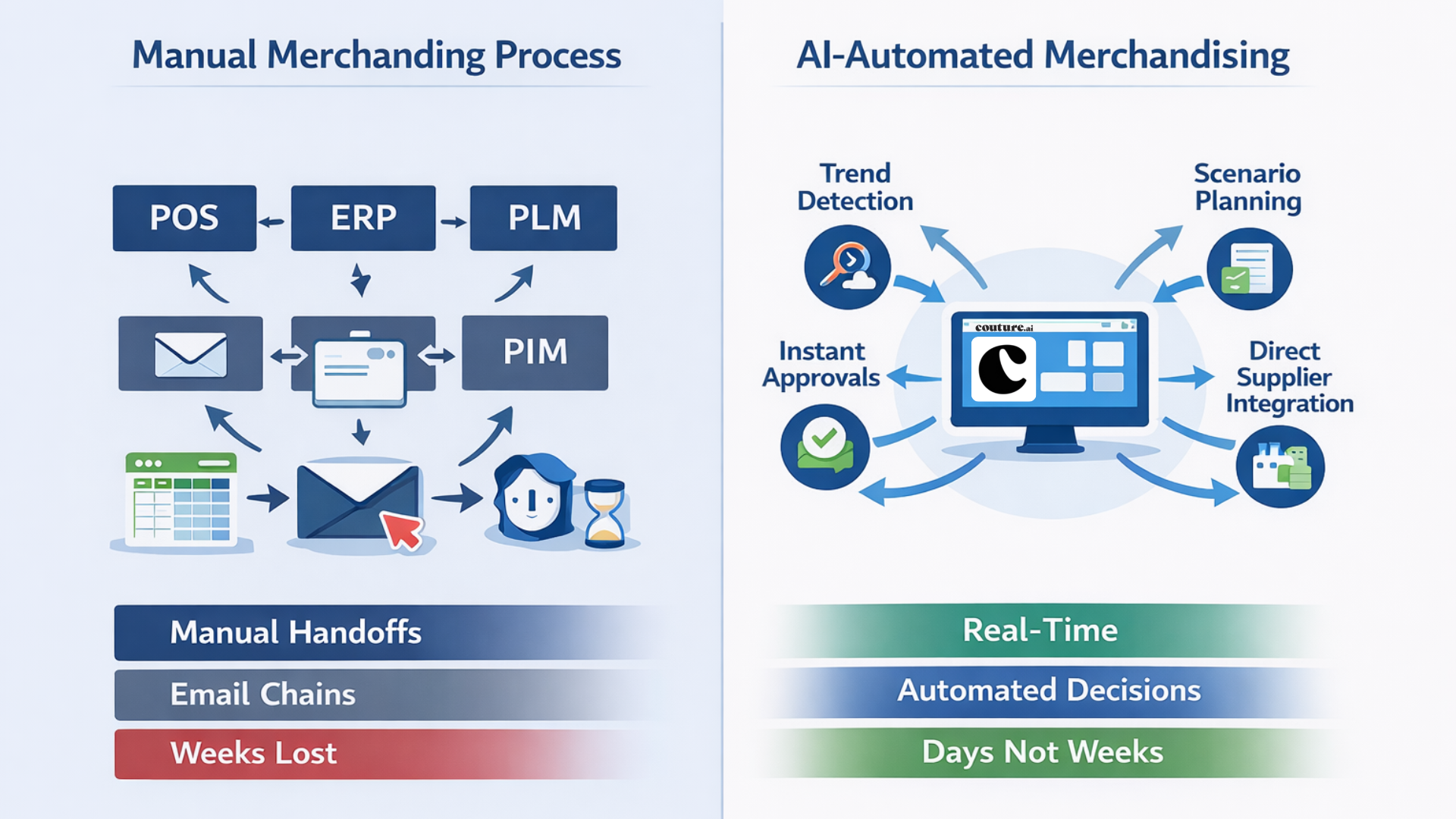

The operational failure is structural: your merchandising strategy still runs on manual handoffs between disconnected systems. Planning software doesn't talk to inventory systems. POS data lives separately from allocation tools. Every transfer requires someone to export, reformat, and import data.

Want to understand the full cost? Read our blog on How Disconnected Systems Quietly Break Retail Operations. We break down exactly where 3-7% of your margin is lost due to SKU errors, allocation mistakes, and late launches.

For visual merchandising, any change needs coordination across dozens or hundreds of stores. The corporation sends guidelines. Regional managers schedule calls. Store teams wait for direction. What should take two days takes three weeks.

This is an infrastructure problem. That's why AI merchandising systems emerged - not as tools that make manual work slightly faster, but as agentic workflows that eliminate the handoffs.

The global retail automation market was valued at USD 24.36 billion in 2024 and is projected to grow in 2025 as retailers invest in systems that remove manual coordination from merchandising operations.

The retailers cutting cycles from twelve weeks to three didn't motivate their teams differently. They deployed AI-powered automation that eliminated manual handoffs.

Here's what their merchandising strategy process looks like:

The fundamental shift: Retail automation handles the repetitive data work. AI surfaces insights. Your team focuses on strategy and decisions, not data compilation.

Industry data shows that the retail automation segment is expected to expand at a 9.3% compound annual growth rate (2024–2030), underlining the broad shift toward automated planning and execution tools.

Let's get specific about what slow cycles are costing you this quarter.

Every quarter you operate on 8-12 week retail planning cycles without automation, you're watching trends peak and fade before your products arrive, discounting inventory that should have sold at full price, tying up capital in the wrong products, losing customers to faster competitors, and burning out your team with manual work that AI could eliminate.

The gap gets wider every quarter. And harder to close.

You're not competing against retailers who work harder. You're competing against retailers who deployed AI-powered automation to eliminate the manual bottlenecks you're still living with.

While you're manually pulling sales data, their AI systems are generating automated alerts for SKU performance. While you're emailing spreadsheets, their intelligent workflows are routing approvals. While you're coordinating visual merchandising changes through email chains, their automation pushes updates instantly to store execution teams.

They're capturing 65-70% of trend demand windows with retail automation. You're capturing 30-35%. That's not a minor gap. That's getting cut in half on every opportunity.

Ready to stop losing to manual processes? Talk to the Couture.ai team about how AI-powered automation eliminates the manual handoffs that eat up 7-8 weeks of your cycle time. We'll show you what retailers are seeing when they move from quarters to weeks with intelligent automation.

Subscribe to get the latest updates and trends in AI, automation, and intelligent solutions — directly in your inbox.

Stay Informed: Insights and Trends from Couture AI

Reduce operational complexity, improve planning accuracy, and deliver smarter retail execution with Couture AI.